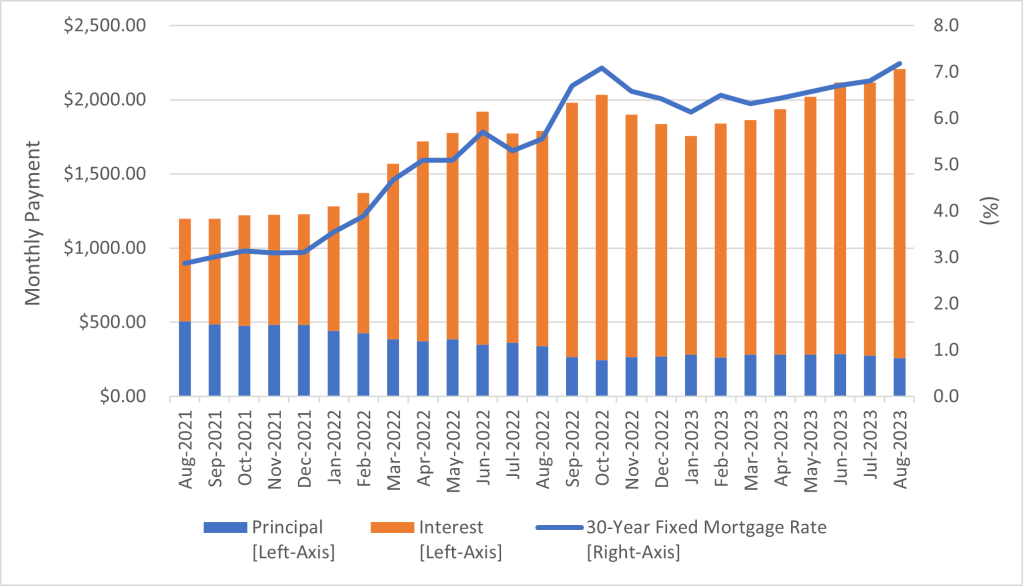

Mortgage rates continued their ascent this week, increasing to 8.0% for a 30-year fixed rate mortgage according to Mortgage News Daily. As illustrated below, since the Federal Reserve began its latest tightening efforts over the past two years to combat inflation, mortgage rates have more than doubled, exacerbating housing affordability issues in an already supply-constrained market. Specifically, the chart below illustrates the rising cost of financing the median priced existing home in the United States using a 30-year fixed mortgage rate and a 20% downpayment. The principal and interest payment breakdown reflects the respective amounts due for a hypothetical borrower’s first monthly payment on the mortgage. As of August 2023, this total monthly payment was higher by more than 84% relative to two years ago.

Figure 1: Housing Affordability Continues to Deteriorate as Mortgage Rates Climb

Source: National Association of Realtors (median U.S. existing home sales price) and Freddie Mac (30-year fixed rate mortgage)

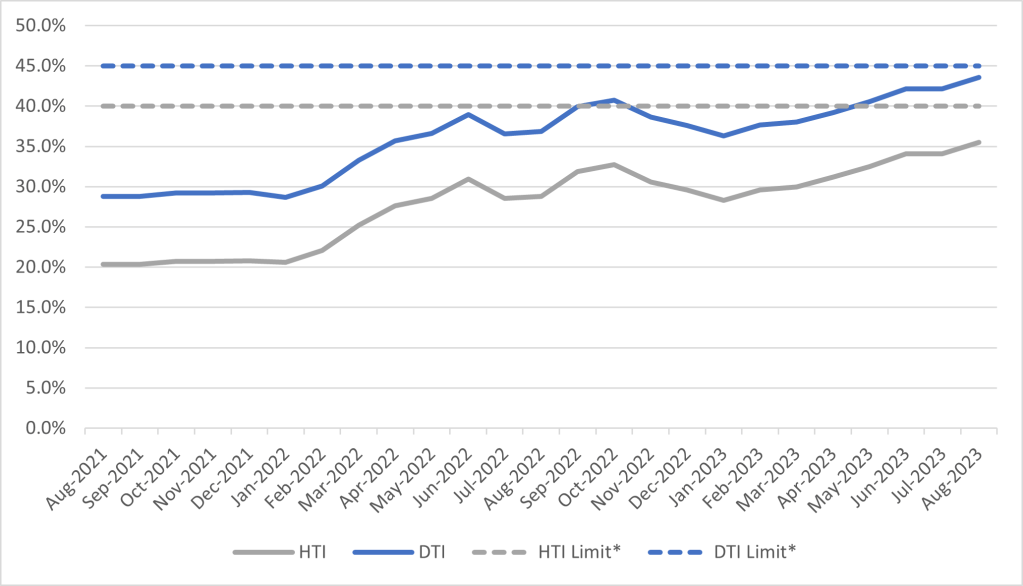

Consequently, two key ratios that underwriters examine when determining credit eligibility for a home purchase have been deteriorating. This includes the housing-to-income (HTI) or front-end ratio and the debt-to-income (DTI) or back-end ratio. The ratios plotted below assume the same monthly payments as above for the numerator while the denominator uses median household income data from the U.S. Census Bureau. Moreover, the DTI ratio assumed a hypothetical $500 constant monthly payment over this period to cover any additional expenses related to credit card debt, student loans, car loans, etc. While the HTI and DTI limits vary by lender, generally speaking, an HTI and DTI ratio above 40% and 45%, respectively could be reason to decline a loan or at least counteroffer the initial terms. In other words, the mortgage might not be approved as-is unless there are other mitigating risk factors elsewhere in the loan application.

Figure 2: Underwriting Metrics Deteriorate in Wake of Higher Mortgage Rates

Source: Freddie Mac and NAR (for debt payments); U.S. Census Bureau (median household income)

*This is not a universal limit as it varies by lender and loan program (conventional, FHA, VA, etc.)